It pre-dates "

textese" and pager codes, but even to individuals familiar with those modern informal languages, real estate lingo may still be incomprehensible.

There are two types of real estate slang: the acronyms used in ads (of which there are over 6,000) and the daily jargon used by real estate industry professionals in their work. If this is your first real estate rodeo, let's bring you up to speed on what you may hear coming from the mouth of your real estate agent.

Contingency: It's surprising how many real estate professionals throw this word around as if everyone knows what it means. "Don't forget, we have to remove that contingency," might just as well mean "I need to see a podiatrist for something growing on my foot."

A contingency is simply a clause in the contract that puts off the terms of the contract until another event occurs. Think of it as saying: "This contract isn't enforceable unless X occurs by such-and-such a date." Common contingencies include the sale of your current home, obtaining a firm offer of financing, the home appraising for at least the loan amount, and acceptable inspection results.

CC&Rs: Covenants, Conditions and Restrictions are the governing documents of a homeowners association. They set forth what are known as deed restrictions – which include how the association operates and the rules and regulations that all homeowners must follow. Although that sounds pretty straightforward, these are important documents that may be challenging to read through.

CID: A Common Interest Development is a combination of individual ownership of property and property held and managed in common among all the individual owners. CID might describe a condominium, planned community or cooperative – any development where the individual owns the unit and shares ownership in the common areas.

Closing Costs: The fees paid at the closing of a real estate transaction are known as closing costs. These costs vary, and some are negotiable and may be paid by the buyer, the seller or both.

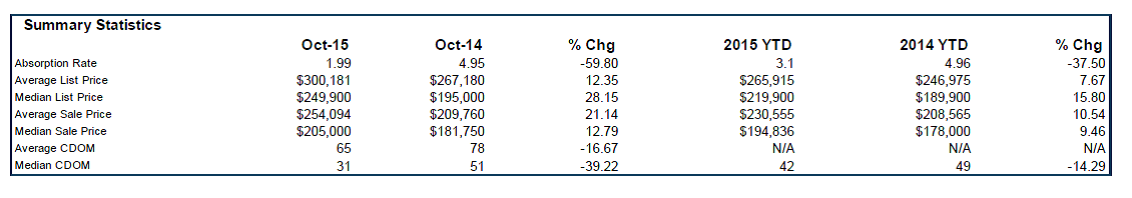

CMA: Comparative Market Analysis. A research report compiled by a real estate agent that analyzes a segment of the housing market to determine the market value of a particular property.

Escrow Impound Account: You will be asked to prepay taxes and insurance when you close on a home. This money goes into an escrow impound account and is used to ensure that these bills are paid on time. Not all mortgages require an escrow impound account, and if your loan-to-value ratio is 80 percent or less, you may be able to have this requirement waived and sometimes the lender will charge you for this.

FHA and HUD: The Federal Housing Administration is an office overseen by the U.S. Department of Housing and Urban Development (HUD). Many Americans assume that "FHA loans" are loans actually granted by this agency. They're not. The FHA guarantees the repayment of the loan granted by a conventional lender.

GFE: Good Faith Estimate. A form supplied by the lender that itemizes the terms and costs of the loan for which you have applied.

HOA: Homeowners Association. This is the governing body of a common interest development. It is made up of a board of directors, elected by the homeowners.

HOI: Homeowner's Insurance. This is required by the lender and it protects the property from hazards such as theft and fire. It also covers your liability or legal responsibility for any injuries on your property, including those caused by pets that live in the home.

HUD-1 Settlement Statement: An itemized list of services and fees charged to the borrower by the lender. By law, the borrower is given at least 24 hours before closing to inspect the HUD-1.

MLS: Multiple Listing Service. A database on which listing brokers share information about properties for sale with other agents. The information contained in the MLS is proprietary and typically not available to the general public.

PITI.: Pronounced "pee-tee," this acronym stands for Principal, Interest, Taxes and Insurance, which, combined, make up your monthly mortgage payment.

PMI: Short for private mortgage insurance, a policy paid for by the borrower but benefitting the lender. Lenders typically require PMI when the loan-to-value ratio exceeds 80 percent.

PUD: Planned Unit Development. These developments are designed to offer amenities and conveniences not found in conventional subdivisions. They are typically governed by a homeowners association. Some PUDs are a mix of residences and retail operations.

REALTOR®: Many consumers assume that all real estate agents are Realtors®. This isn't true. A real estate agent must be a dues-paying member of the National Association of Realtors® to legally use the term REALTOR®. (The association requires the registered trademark symbol be used with the term.)

Title Insurance: There are two types of title insurance policies. One covers a buyer's interest in real property. The second type protects the lender. Title insurance is necessary to protect your interest from other claims of ownership.

TDS: Transfer Disclosure Statement. This describes a form that is filled out by the seller and given to the buyer as part of the disclosure process. The TDS contains a list of questions that must only be answered by the seller (not by his or her agent). Some of these questions are about the condition of the property and whether or not the seller has knowledge of any major repairs made to the house and items on the property, such as burglar alarms, sump pumps and even rain gutters.

VA Loan: A mortgage offered to U.S. service members, veterans and sometimes spouses that is guaranteed by the U.S. Department of Veterans Affairs.

Zero-lot line: When a home sits right on the lot's boundary, with little or no space between homes, it is said to have a zero-lot line.